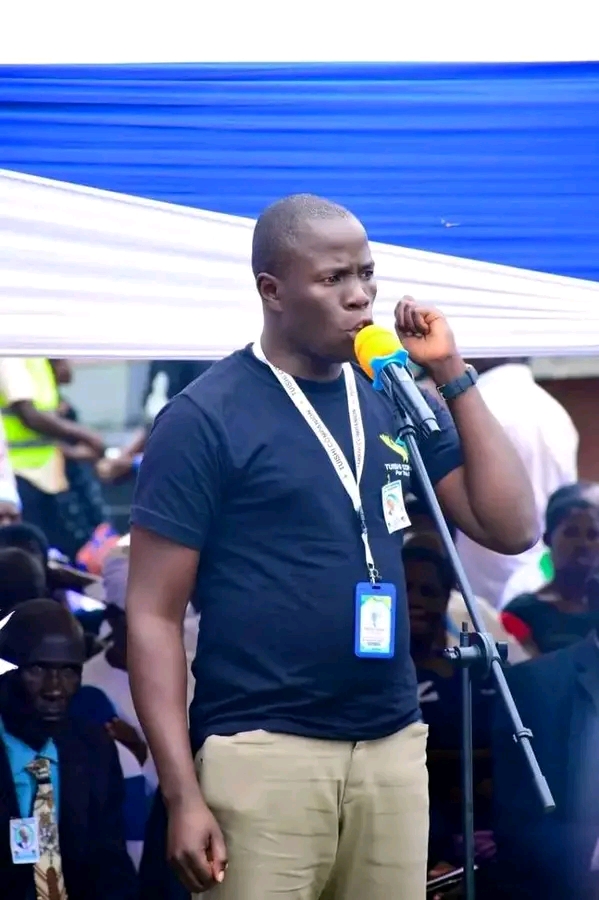

Homa Bay county governor Gladys Wanga during the opening of the KCB Kendu Bay branch on Monday 9th /Photo, Governor Gladys Wanga Communication Press/

December 9, 2024, marked a new journey for Kendu Bay town residents as they witnessed the opening of the first bank in the area since its inception.

Founded over a century ago, Kendu Bay served as a bustling hub for Arab traders during the late 19th and early 20th centuries. Leveraging its access to the railway from Mombasa and Lake Victoria, it flourished as a commercial center in South Nyanza.

However, the decline of water transport systems in the 1980s precipitated a downturn, leading to a mass exodus of residents seeking better economic opportunities. This migration allowed neighboring towns like Oyugis to thrive, attracting financial institutions and diversified business ventures.

Kenya Commercial Bank (KCB), through its X page, announced the of its branch in Kendu Bay,noting that the development was a significant milestone for both the bank and the local community.

“KCB Bank is proud to announce the opening of our first branch in Kendu Bay – a significant milestone for both the bank and the local community!” KCB Bank wrote on X.

The news was met with excitement from Kendu Bay residents, who have waited over a century for a commercial bank. This milestone provides a promising opportunity for Homa Bay County’s fifth-largest urban center to further drive economic growth and restore its reputation as a thriving commercial hub.

Speaking during the branch opening, Homa Bay County Governor Gladys Wanga thanked the bank for considering Kendu Bay, adding that the launch presents a brighter future for the town.

KCB’s entry into Kendu Bay has reignited hopes for economic revival among residents and local business owners, who view the establishment of a bank as a recognition of the town’s untapped potential.

The presence of KCB is anticipated to help provide secure savings options and more reasonable loans.

Wholesale shop operators Fred Odhiambo and Mohamed Ibrahim shared insights into the operational disruptions they experience due to frequent trips to Oyugis for banking, which they say, exposed them to the risk of robbery and financial losses.

The community has also faced significant challenges from informal money lenders, known as shylocks, who often demand household items as collateral for small loans. This has led to tragic consequences for traders unable to repay their debts.

The establishment of KCB is expected to enhance both safety and operational efficiency for businesses in Kendu Bay.

The Kendu Bay branch becomes the 209th branch of KCB Bank across the country, as the bank continues its mission to reach wider markets.